When a loved one passes away, the immediate financial instinct for many Executors is to “clear the decks”—to pay off the credit cards, the utility bills, and the personal loans to stop the letters from arriving.

However, in the eyes of UK law, this instinct can be a multi-thousand-pound mistake.

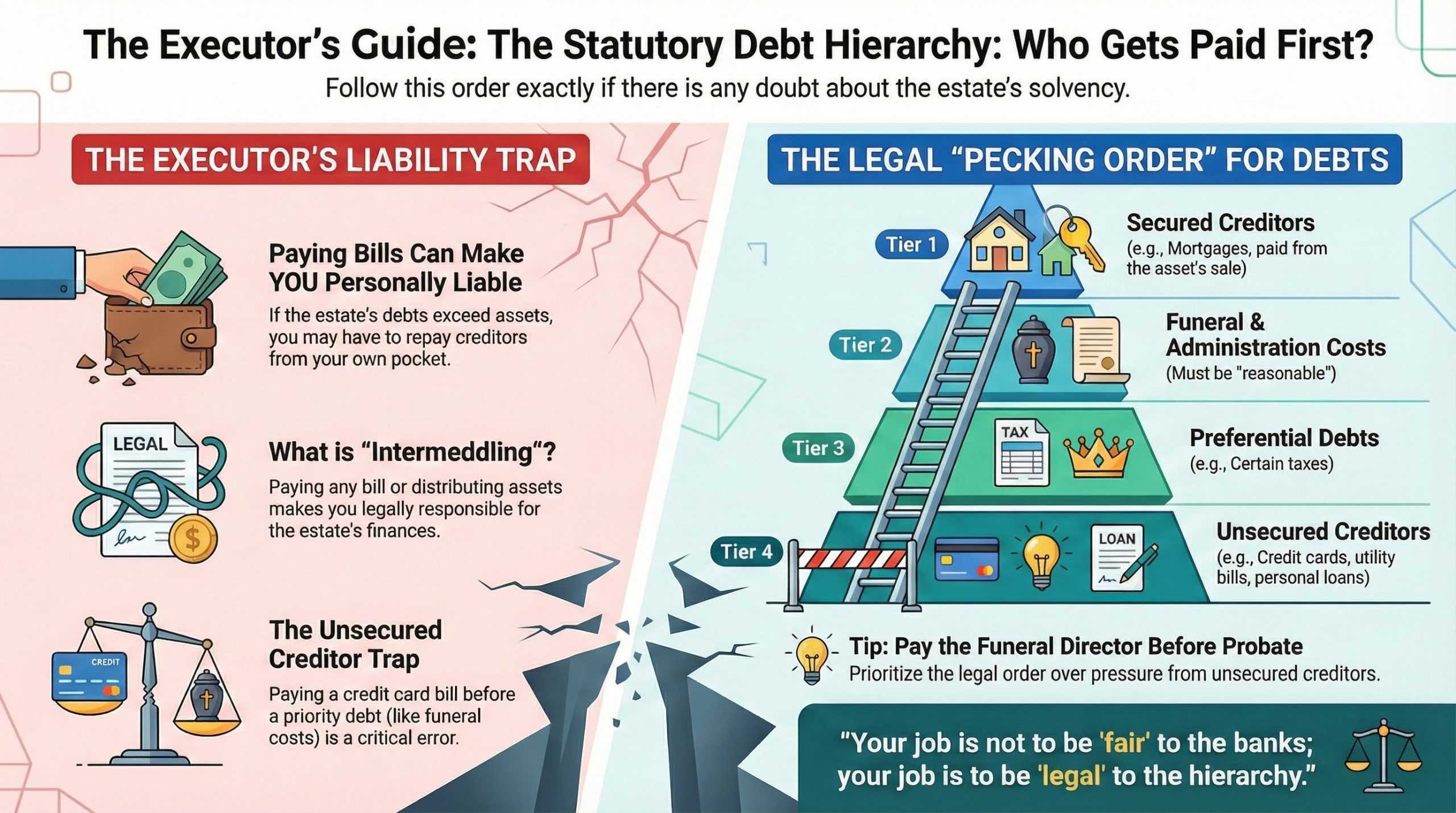

Under the Administration of Insolvent Estates of Deceased Persons Order 1986, there is a strict “Statutory Priority” of who gets paid and when. If you pay an “unsecured” creditor (like a credit card) before a “priority” creditor (like the funeral director or HMRC) and the estate later turns out to be insolvent, you—the Executor—could be held personally liable for the deficit.

This guide explains the technical logic of debt priority to protect your personal assets and ensure the estate is handled legally.

1. The Statutory Hierarchy: Who is First in Line?

In England and Wales, debts are not treated equally. They are categorized into a “Pecking Order” that every Executor must follow. If the estate has plenty of money, the order matters less; however, if there is any doubt about the estate’s solvency, you must follow this list exactly:

Tier 1: Secured Creditors

Debts secured against an asset (like a mortgage) are paid from the proceeds of that asset. If the house is sold, the mortgage lender takes their share before a penny goes elsewhere.

Tier 2: Reasonable Funeral, Testamentary, and Administration Expenses

The law recognizes that a person must be buried or cremated. Consequently, funeral costs take priority over almost all other unsecured debts. This is why the funeral director is legally entitled to payment before the bank.

- EstateOS Tip: “Reasonable” is the operative word. A gold-plated casket for an estate with £5,000 in assets may be challenged by other creditors.

Tier 3: “Preferential” Debts

This includes certain types of tax and specific arrears (though this category has narrowed significantly in recent years).

Tier 4: Unsecured Creditors (The “Trap”)

This is where most “household” debt sits:

- Credit cards

- Unsecured personal loans

- Utility bills

- Store cards

The Rule: You cannot pay a Tier 4 debt if it would leave the estate unable to pay a Tier 1 or Tier 2 debt.

2. The Danger of “Intermeddling” and Personal Liability

In legal terms, an Executor who begins paying bills or distributing assets is “intermeddling” in the estate. While this is your job, it carries a heavy burden: fiduciary duty.

If you pay off a £3,000 credit card bill today, and three months from now a “hidden” debt appears (such as a DWP overpayment recovery) that makes the estate insolvent, the DWP can argue that you “misapplied” the estate funds. They may demand that you pay that £3,000 back into the estate from your own pocket because you paid an unsecured creditor out of turn.

3. How to Force the Bank to Pay (BCOBS 5.1)

One of the biggest pain points for families is having the money in the deceased’s bank account but being told by the bank, “We can’t release it without Probate.”

This is often incorrect. Under the Banking Conduct of Business Sourcebook (BCOBS) 5.1, banks are encouraged to release funds for funeral costs and Inheritance Tax (IHT) before Probate is granted.

The Strategy: 1. Do not pay the funeral bill from your personal account. 2. Take the original invoice and the death certificate to the deceased’s bank. 3. Cite BCOBS 5.1 and request they pay the Funeral Director directly from the account. 4. Most high-street banks have a “Bereavement Trigger” that allows this payment within 48 hours.

4. Why This Matters Now

With the current economic climate, more estates are becoming “technically insolvent” (where debts exceed assets). Using a tool like the [EstateOS Debt Priority Checker] allows you to categorize bills as they arrive, ensuring you never sign off on a payment that puts your personal finances at risk.

As noted in the original analysis on Washington Celebration of Life, understanding the distinction between “secured” and “unsecured” debt is the first line of defense for any modern Executor.

Expert Summary

The law protects the funeral director and the taxman first. The credit card company sits at the back of the queue. As an Executor, your job is not to be “fair” to the banks; your job is to be “legal” to the hierarchy.

Next Step: If you have received a “Final Demand” from a credit card provider for a deceased loved one, do not pay it yet. Map out the estate’s total assets and Tier 2 expenses first to ensure you aren’t walking into a liability trap.

Leave a Reply